First, we will consider Libya. There was so much coverage of the overthrow of Gaddafi (or however you spell his name; his revenge on the world will be in the history books with all the confusion over how to render his name in English) in Libya, that it really wasn't much of a temptation to add to it. Of course, now I have a reason... :)

On March 22, 2011, the Treasury Department published a press release entitled Treasury Identifies 14 Companies Owned by Libya’s National Oil Corporation as Subject to Sanctions, listing Libyan companies whose assets were frozen in order to help force Gaddafi from power. The press release included this comment:

Treasury will continue monitoring the National Oil Corporation’s operations in Libya. Should National Oil Corporation subsidiaries or facilities come under different ownership and control, Treasury may consider authorizing dealings with such entities.

Economic analyst Robert Wenzel immediately picked up on this, and called attention to it in a post entitled If You Don't Think Libya Is About Oil, Read This.

Interestingly, the contingency foreseen in the Treasury Department press release happened almost simultaneously with the press release. From Libyan Rebel Council Forms Oil Company to Replace Qaddafi's (please see the original for further information and for links which I did not reproduce):

Libyan rebels in Benghazi said they have created a new national oil company to replace the corporation controlled by leader Muammar Qaddafi whose assets were frozen by the United Nations Security Council.

The Transitional National Council released a statement announcing the decision made at a March 19 meeting to establish the "Libyan Oil Company as supervisory authority on oil production and policies in the country, based temporarily in Benghazi, and the appointment of an interim director general" of the company.

The Council also said it "designated the Central Bank of Benghazi as a monetary authority competent in monetary policies in Libya and the appointment of a governor to the Central Bank of Libya, with a temporary headquarters in Benghazi."

The Security Council adopted a resolution on March 17 that froze the foreign assets of the Libyan National Oil Corp. and the Central Bank of Libya, both described in the text as "a potential source of funding" for Qaddafi's regime.

Linking to this article, Wenzel explained its significance on March 28. From Libyan Rebels Form Central Bank:

Here's one for the Guinness Book of Records. The Libyan rebels in Benghazi said they have created a new national oil company to replace the corporation controlled by leader Muammar Qaddafi whose assets were frozen by the United Nations Security Council and have formed a central bank!

The Transitional National Council released a statement announcing the decision made at a March 19 meeting to establish the "Libyan Oil Company as supervisory authority on oil production and policies in the country, based temporarily in Benghazi, and the appointment of an interim director general" of the company.

The Council also said it "designated the Central Bank of Benghazi as a monetary authority competent in monetary policies in Libya and the appointment of a governor to the Central Bank of Libya, with a temporary headquarters in Benghazi."

This suggests we have a bit more than a rag tag bunch of rebels running around and that there are some pretty sophisticated influences.

I have never before heard of a central bank being created in just a matter of weeks out of a popular uprising.

Wenzel finishes his article calling the rebels "puppets and cover".

The topic was picked up by CNBC in an article entitled Libyan Rebels Form Their Own Central Bank, dated March 28, 2011, which echoed and referenced Wenzel's analysis:

Libyan rebels in Benghazi say they have formed their own central bank.

[snip]

Is this the first time a revolutionary group has created a central bank while it is still in the midst of fighting the entrenched political power? It certainly seems to indicate how extraordinarily powerful central bankers have become in our era.

Robert Wenzel of Economic Policy Journal thinks the central banking initiative reveals that foreign powers may have a strong influence over the rebels.

This suggests we have a bit more than a ragtag bunch of rebels running around and that there are some pretty sophisticated influences. "I have never before heard of a central bank being created in just a matter of weeks out of a popular uprising," Wenzel writes.

Further analysis comes from Patrick Henningsen. From Globalists Target 100% State Owned Central Bank of Libya, March 28, 2011:

Eric V. Encina writes: One seldom mentioned fact by western politicians and media pundits: the Central Bank of Libya is 100% State Owned. The world’s globalist financiers and market manipulators do not like it and would continue to their on-going effort to dethrone Muammar Muhammad al-Gaddafi, bringing an end to Libya as independent nation.

Currently, the Libyan government creates its own money, the Libyan Dinar, through the facilities of its own central bank. Few can argue that Libya is a sovereign nation with its own great resources, able to sustain its own economic destiny. One major problem for globalist banking cartels is that in order to do business with Libya, they must go through the Libyan Central Bank and its national currency, a place where they have absolutely zero dominion or power-broking ability. Hence, taking down the Central Bank of Libya (CBL) may not appear in the speeches of Obama, Cameron and Sarkozy but this is certainly at the top of the globalist agenda for absorbing Libya into its hive of compliant nations.

When the smoke eventually clears from all the cruise missiles and cluster bombs, you will see the Allied reformers move in to reform Libya's monetary system, pumping it full of worthless dollars, priming it for a series of chaotic inflationary cycles.

[snip]

Libya also holds more bullion as a proportion of gross domestic product than any country except Lebanon, according to the London-based World Gold Council using January data from the International Monetary Fund. The value of gold is based on the March 25 close of $1,429.74 an ounce.

Will this gold remain in Libya once Allied forces have taken control of Tripoli, or will it lost, or exchanged for pallets upon pallets of paper aka US dollars?

FOLDING LIBYA INTO THE NEW WORLD ORDER

In the Libyan banking charter, one of the primary mandates will be that it is regulating the quantity, quality and cost of credit to meet the requirements of economic growth and monetary stability. This of course, is the very opposite role which privately owned central banks play elsewhere in the world. Private central banks elsewhere create inflation, periodically inflating bubbles by design and then popping them in order to transfer large sums of wealth out of lower and middle class hands and into the hands of the financial elites.

More analysis is provided by Ellen Brown. From Libya all about oil, or central banking? April 14, 2011:

Whatever might be said of Gaddafi's personal crimes, the Libyan people seem to be thriving. A delegation of medical professionals from Russia, Ukraine and Belarus wrote in an appeal to Russian President Dmitry Medvedev and Prime Minister Vladimir Putin that after becoming acquainted with Libyan life, it was their view that in few nations did people live in such comfort:

[Libyans] are entitled to free treatment, and their hospitals provide the best in the world of medical equipment. Education in Libya is free, capable young people have the opportunity to study abroad at government expense. When marrying, young couples receive 60,000 Libyan dinars (about 50,000 US dollars) of financial assistance. Non-interest state loans, and as practice shows, undated. Due to government subsidies the price of cars is much lower than in Europe, and they are affordable for every family. Gasoline and bread cost a penny, no taxes for those who are engaged in agriculture. The Libyan people are quiet and peaceful, are not inclined to drink, and are very religious.

They maintained that the international community had been misinformed about the struggle against the regime. "Tell us," they said, "who would not like such a regime?"

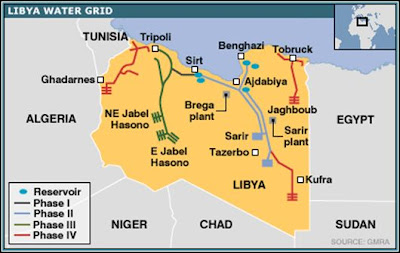

Even if that is just propaganda, there is no denying at least one very popular achievement of the Libyan government: it brought water to the desert by building the largest and most expensive irrigation project in history, the US$33 billion GMMR (Great Man-Made River) project. Even more than oil, water is crucial to life in Libya.

The GMMR provides 70% of the population with water for drinking and irrigation, pumping it from Libya's vast underground Nubian Sandstone Aquifer System in the south to populated coastal areas 4,000 kilometers to the north. The Libyan government has done at least some things right.

Another explanation for the assault on Libya is that it is "all about oil", but that theory too is problematic. As noted in the National Journal, the country produces only about 2% of the world's oil. Saudi Arabia alone has enough spare capacity to make up for any lost production if Libyan oil were to disappear from the market. And if it's all about oil, why the rush to set up a new central bank?

Another provocative bit of data circulating on the Net is a 2007 "Democracy Now" interview of US General Wesley Clark (Ret). In it he says that about 10 days after September 11, 2001, he was told by a general that the decision had been made to go to war with Iraq. Clark was surprised and asked why. "I don't know!" was the response. "I guess they don't know what else to do!" Later, the same general said they planned to take out seven countries in five years: Iraq, Syria, Lebanon, Libya, Somalia, Sudan, and Iran.

What do these seven countries have in common? In the context of banking, one that sticks out is that none of them is listed among the 56 member banks of the Bank for International Settlements (BIS). That evidently puts them outside the long regulatory arm of the central bankers' central bank in Switzerland.

[snip]

Libya not only has oil. According to the International Monetary Fund (IMF), its central bank has nearly 144 tonnes of gold in its vaults. With that sort of asset base, who needs the BIS, the IMF and their rules?

[snip]

So is this new war all about oil or all about banking? Maybe both - and water as well. With energy, water, and ample credit to develop the infrastructure to access them, a nation can be free of the grip of foreign creditors. And that may be the real threat of Libya: it could show the world what is possible.

Skiping down:

If the Gaddafi government goes down, it will be interesting to watch whether the new central bank joins the BIS, whether the nationalized oil industry gets sold off to investors, and whether education and healthcare continue to be free.

Well, guess what?

Bank for International Settlements' link to the Central Bank of Libya:

Freedom and human rights comprise the cover story for oil. Oil, though, is the cover story for water - without which humans cannot live - and money - which, if properly manipulated, enslaves humanity.

But, what else lurks beneath the surface?

No comments:

Post a Comment